15 August 2012

The euro crisis is on everyone's lips and one disaster has hardly had to time to dissipate before the next arrives. Germany is putting up billions, Greece is still sinking despite bailout fund, Spain and Italy are teetering on the edge of the abyss, the financial markets are fluctuating between nervousness and hysteria. Mainz economist Professor Dr. Philipp Harms tries to remain objective in view of the situation.

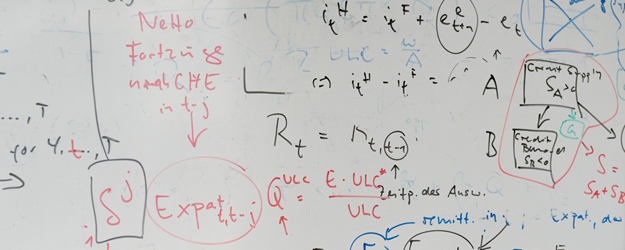

Professor Dr. Philipp Harms has an aura of calm about him. "Do you want a glass of water?" he asks before he sits down to talk about a very exciting topic. A blackboard covered in mathematical formulas hangs on a wall in his office. The computer on his desk displays a graphic. It shows the fever curves of government debt. Harms will be using these in our discussion of the euro crisis.

"Actually it is not really a currency crisis. It is a mixture of a financial crisis together with a predominantly government debt crisis," says the Professor for International Economics of the Faculty of Law, Management and Economics at Johannes Gutenberg University Mainz (JGU). "At some point, people started to use the term 'euro crisis', probably at too early a point in time." The whole thing developed its own vicious dynamic. "In London, Mumbai, New York, and Shanghai, investors are now betting on how long the euro will survive."

Euro stronger than when launched

This excessive pessimism is having a terrible impact on financial markets. However, Harms gives us something to mull over: "Even though the euro is weaker than it was five years ago, it is still stronger than when it was launched."

The economist invites us to take a closer look. He points to his computer graphic. "The one up there is Japan." The curve is almost at the 250-percent mark. The debt levels are that high in a country whose government is still considered creditworthy. Greece trails far behind at 150 percent and the US follows at almost 100 percent. "The Greek government is paying 25-30 percent interest to borrow money while the Japanese are paying less than one percent. It is difficult to understand how this can be justified."

Cooked Greek books

Here the pendulum, which once swung in Greece's favor, has returned to move in the opposite direction. "In the early 2000s, interest rates converged in Europe." The newly founded euro zone was seen as a single unit and all of its countries could borrow money from the financial markets at the same conditions. The Greeks, however, had gotten into the zone by cooking their books and once the country was a member it was able to live beyond its means as a consequence. "A lot went wrong when the euro was launched. It is also hard to reconcile this retrospectively with the European concept."

The pendulum has now moved to the other extreme and, as a result, Greece is having to pay horrendous interest rates. The financial markets no longer trust the country's economy and the agencies have all downgraded Greece's credit rating.

German government on the right path

Greece is actually facing a whole series of problems: "Its economy needs to be much more integrated in the international production networks. Comparable countries, such as Turkey and Poland, have a larger output of manufactured goods that go on to other countries for finishing," This safety net is lacking in Greece. "Also wages are too high in comparison with productivity."

In the face of the crisis, Harms thinks that the German government is at present more or less on the right course. "The aim is to give Spain, Italy, and Greece a bit of breathing space over the short term. At the same time, they are demanding that these countries need to be more disciplined about debt and restructure their economies."

Restructuring reforms need time to take effect and not everybody realizes this. "When German politicians say that nothing is happening in Greece this is because they are not adequately informed. There is a lot happening."

Put rating agencies on hold

Financial markets, the media, and rating agencies simply will not leave the countries alone. All the media brouhaha about the downgrade is proving particularly disastrous in view of the sensitivity of the financial markets. "The best thing would be to simply give Spain, for instance, a few weeks of peace and quiet." Harms has an example of how much good this can do. "In the fall and winter of 2010/2011, it looked very much as if Ireland's days were numbered. Now nobody sees it as doomed and the country appears to be on the road to recovery." The strategy of providing short-term relief and demanding long-term restructuring in return is beginning to bear fruit in Ireland and the country is now no longer in the line of fire.

Gysi would do the exact same thing

This carrot and stick approach may seem inconsistent, as the reactions to German policies indicate. "On the one hand, the Greek press prints caricatures of Merkel labeled with a swastika while many in this country think she is going too easy on the Greeks. I am pretty sure that Gregor Gysi of the German Left Party would admit off the record that his party would not act much differently in this situation."

Harms understands why some people are nervous. "Germany is making enormous commitments." At the same time he provides food for thought: "Up to now, not much in the way of finances has actually changed hands and Germany has even profited from the crisis. It can now borrow money at conditions that would have been unthinkable years ago."

The euro crisis will have long-term consequences. "The doubts about the system in the wake of the 2009 financial crisis have been crowded out by questions of detail, which are having massively greater effect." People no longer ask whether it is the capitalist system that is the root cause of the problem. "One question that has arisen is that of how the burden can be spread among taxpayers." And this, in view of the increasing concentration of wealth over the last few decades, means that Harms foresees a dramatic shift. "I have no doubt that we are going to see a massive redistribution of wealth."

Euro crisis on its way to becoming a footnote?

In addition, more regulation of financial markets is already being introduced. "The requirement that banks should retain a larger proportion of their own assets is already a significant change and is giving them headaches at the moment."

Finally, Harms has to admit that he is an optimist. "I don't think we are about to crash anything vital into the wall." Harms does not even see an end to growth. "It's not the case that we have a bucket of prosperity that will be empty at some point. People are inventive and growth does not always have to come at the cost of the environment. Just look at modern information technology," he says as he points to his PC.

After two hours of intense discussion, the glass of water in front of Harms is still half full. "I think that the euro crisis will end up as a footnote in our history. We are facing much more important issues. Just look at demographic change and global warming." His face assumes a more somber expression. Time to take another look at his glass of water: Perhaps it is half empty after all?